Jamie Redman

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tari Labs University, miningpoolstats.stream

3 min read

The recent dip in Bitcoin’s hashrate has caused concerns among cryptocurrency enthusiasts. However, this has also presented an opportunity for merge-mined crypto asset networks, which can benefit from the increased hashrate of miners who are still dedicated to Bitcoin. Merge-mining allows miners to mine multiple cryptocurrencies at the same time, using the same hash power, without affecting their mining rewards for Bitcoin.

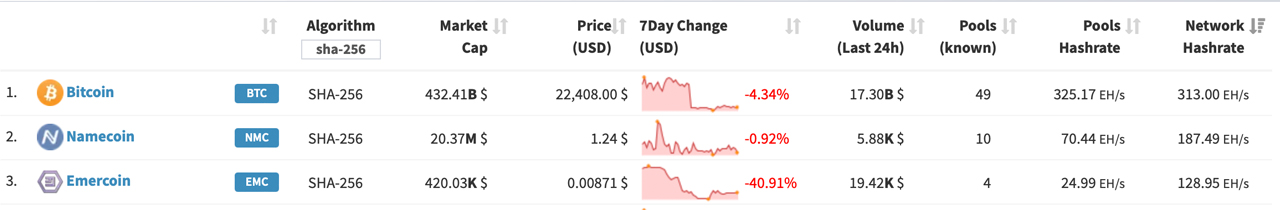

Merge-mined networks such as Namecoin, Emercoin, and Syscoin have already been benefiting from the higher hashrate, which has made them more secure and profitable for miners. Namecoin, in particular, has seen a significant increase in its hashrate, which has made it more resistant to 51% attacks.

The benefits of merge-mining go beyond increased security and profitability for smaller networks. It also reduces the risk of a chain split, which can occur when miners switch to another cryptocurrency, leaving the original network vulnerable. By allowing miners to mine multiple cryptocurrencies simultaneously, merge-mining encourages them to stay invested in the original network, making it more stable and less prone to attacks.

In conclusion, while Bitcoin’s hashrate remains sky-high, merge-mined crypto asset networks can benefit from the increased hashrate, making them more secure and profitable for miners. Merge-mining also reduces the risk of chain splits, making smaller networks more stable and less vulnerable to attacks.

Bitcoin’s hashrate secures the network and provides rewards for miners participating in the system, but mining pools also dedicate computational power to networks like Namecoin, Elastos, Emercoin, and Vcash. For example, Namecoin has a hashrate of around 187 EH/s today, and some of the top bitcoin mining pools merge-mine the network to acquire namecoin (NMC) rewards.

Merge mining is a process in which miners can mine various cryptocurrencies at the same time without any additional cost. Merged mining is similar to a person playing Pac-Man and Asteroids at the same time, using the same joystick and earning rewards for both games. Namecoin was the first cryptocurrency project to be merge-mined, as it shares the same SHA256 algorithm as Bitcoin, and the first merge-mined block on the network was mined on Sept. 19, 2011.

Bitcoin pools that dedicate hashrate to the Namecoin chain include F2pool, Viabtc, Poolin, and Mining Dutch. While F2pool is the fourth largest bitcoin mining pool over the last three days, it’s the largest namecoin miner as it dedicates its entire 44 EH/s to the Namecoin network. Viabtc dedicates 26.25 EH/s to the Namecoin chain, and Poolin points 5.10 EH/s toward Namecoin as well. At the time of writing, a single namecoin (NMC) is worth $1.24 per unit and 12.5 NMC plus fees are distributed in each block reward.

Namecoin has the second-largest hashrate among SHA256 blockchains, but the Emercoin (EMC) network is the third-largest under BTC and NMC. EMC has 93.38 EH/s dedicated to the network, and Mining Dutch and Viabtc are the top miners for the coin. Viabtc, which is BTC’s fifth-largest mining pool by hashrate, also dedicates 26.76 EH/s to EMC. The Emercoin network leverages a hybrid proof-of-work (PoW) and proof-of-stake (PoS) consensus mechanism. A single emercoin (EMC) is currently changing hands for $0.0088 per coin.

Meanwhile, Viabtc dedicates the same amount of hashrate to the Syscoin (SYS) network, another hybrid PoW and PoS blockchain. Today, a single SYS trades for $0.167 against the U.S. dollar. In addition to the aforementioned PoW cryptocurrencies that leverage the SHA256 consensus algorithm, miners are also dedicating hashrate to networks such as Xaya, Veil, Hathor, Elastos, and Vcash. Older cryptocurrency networks like Terracoin (TRC) and Unobtanium (UNO) also see a small fraction of SHA256 hashrate.

F2pool dedicates 44.32 EH/s to Vcash, but the coin’s native asset has no listed value on any of the top coin market aggregation sites. Elastos has over 100 exahash dedicated to the chain, and top mining pools like Antpool, F2pool, Viabtc, and Mining Dutch are dedicating hashrate to the Elastos network. Current statistics further show that 100 exahash per second is also dedicated to the RSK smart contract network.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tari Labs University, miningpoolstats.stream

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.